Wednesday, December 18, 2013

Going to Bat for Peter Schiff (crosspost)

I will be posting there again very soon.

Saturday, September 14, 2013

Larken's Liberty-Baiting

Larken Rose is an outspoken proponent of radical, stateless libertarianism. In an infamous article, When Should You Shoot a Cop, and a recent speech at Porcfest, he has challenged a taboo among the libertarian movement, particularly the Free State Project, by asserting our right to use physical force in self defense against government agents. While he appears to make a compelling case, I think that it's important to highlight some important problems with his arguments.

Libertarian Guilt Trip

Most recently, there was a video in reaction to the expulsion of Christopher Cantwell from the Free State Project, who wrote a controversial article in a similar vein:

The first problem I have is that Larken is taunting us by telling us that we're afraid to address the issue, and painting people's condemnation of his point as fear of addressing the arguments. I agree with Larken that ignoring it is a weak tactic, which is why I'm responding. Hiding would merely strengthen Larken's point that the only thing standing between us and the truth is fear of facing an uncomfortable reality. This would embolden and isolate the ranks of people with this brave and potentially dangerous point of view.

I initially took him at his word, and I personally understand the desire to just make this issue go away. But considering that they let him talk at Porcfest, and that people debate the issue quite rationally on Free Talk Live (a radio show heavily connected with the Free State Project) for days on end, Ian giving him due respect, I think that Larken, to some extent, is crying censorship as a persuasive tactic.

A Free Agent

The next problem I have is that Larken makes the argument that organizations such as the Free State Project, which hold an official ideological position, stifle progress. As a member of an organization, things you say are to some extent representative of the organization, and Larken considers this a limiting factor. To address this, consider the ways in which one can act as part of a group.

In reaching ends (not just political ends), libertarianism, in my opinion, does not promote collective efforts, but it does promote concerted efforts. The difference is that in a concerted effort, membership in the group is not a matter of identification with the group, but rather a revocable agreement with its means and goals. If a group of people are considering conducting a concerted effort, there needs to be an description of what that effort is, so that people can decide whether or not to join. The description is pivotal, because every member of the group understands that every other member joined with the understanding given in the description. If a member does not meet the description, the leadership should consider removing them from the group. If the official description is not adhered to by the leadership in this or other ways, the disappointed members should consider leaving.

It may be a bit of a drag on progress, but it gives other people an important assurance as to what they're getting themselves into. If Chris Cantwell wants to take a position contrary to the means of the Free State Project, that's great. But I am strongly considering joining the Free State Project, and I, for one, don't want to join an organization that tacitly supports Chris's point of view. As such, it makes me comfortable to know that, in joining the Free State Project, I will be among others who feel comfortable with this decision. Chris, for his part, should find another concerted effort that matches his means.

The same could be said about headless movements. Larken amusingly goes on to say that there should be a splinter in the movement between people willing and not willing to use violence in self defense against government agents, and that the latter aren't true advocates of liberty. What if somebody called themselves a libertarian and advocated for socialized medicine? You'd tell them "sorry you don't understand libertarianism, you're not really one of us". It's basically the same thing, less formally instituted.

What would be dangerous is if an organization was not the holder of the banner, but was the banner itself. At this point the organization would represent a collective effort, which is identification with a group rather than just adherence to a principle. This is the concern that Larken is expressing, and to this extent it is valid. However so far, I don't think it applies to the Free State Project. (What does trouble me about the Free State Project is that it seems to be engaging in mission creep. I liked it better when it just planned to get everybody into New Hampshire, and dissolve thereafter.)

Daring to Speak of Violence

Now let's get to the meat of the matter. Here's his talk at Porcfest, "Why Speak of Violence":

Let's look at his first basic assumptions. 1) It is moral, according to the Non-Aggression Principle, to use deadly force, as necessary, for self preservation. 2) The aggressor having a badge does not create an exception. So much I agree on. Well, so what? Larken acts as if it is only the most enlightened, intellectually honest libertarians who would come to this conclusion. In reality, I think almost everybody, libertarian or not, will agree with this given the proper hypothetical. In Indiana, it's not only a socially acceptable position, it's LEGAL.

Further, I'd argue that almost everybody, libertarian or not, would agree that there are certain hypothetical situations in which a government "goes rogue", where it's time to take up arms (assuming there was any hope in the endeavor). Guns rights activists talk about this hypothetical all the time.

This, again, only serves to put Larken in the position of being the holder of some inconvenient truth. Don't be fooled, there's nothing that compelling about this point. The point that is compelling, however, is where he makes this argument in the context of activism. As an activist, your job is to go against the grain of public opinion. Practically, this is the difference between defending yourself against a police officer who is threatening you without giving you an option to comply, and forcefully defending yourself against a police officer because you don't want to obey a law. I understand that this is not important from a moral standpoint, but it is important from the standpoint of acceptance across society. Larken is clear that he is not advocating revolution, but when there is an institution whose actions are respected by the critical mass of the population as legitimate, using deadly force to defend against it may as well be a violent revolt.

To continue such an effort en mass as libertarians without eventually complying (and Larken implies that at some point we should all stop complying), it may necessarily require what even he would call a violent revolution. Activism is about persuading the public. Anything that requires force to overcome the critical mass of public opinion will render a large demand among the population for a counter-revolt. This is why many of us advocate what is often dubbed as "Peaceful Evolution". This is the true reason that the idea of shooting police officers in defense of our freedom makes some of us nervous, because so many in history have used injustice as a justification for such actions, almost always to awful ends.

Larken's Calculus

Finally, let's look at Larken's calculus of force in society, which can be described as, "Freedom occurs when the good guys are more willing to use deadly force than the bad guys.". I think this is an oversimplification; more accurately, the calculus is, "Freedom occurs when people are more willing to use deadly force for good than for bad.". Note the subtle distinction. I'm not inclined to think that anywhere near 100% of the police force is comprised of evil people. They are full of good people on some bad missions. Perhaps on a power trip, but they are still driven by an ideology. That is why we believe that peacefully promoting and demonstrating a countering ideology is a potentially effective strategy. To begin to turn the tables, we need to turn minds.

But, Larken would ask, what about to finish turning the tables? What about the remaining, truly evil people in the forces? Don't we need some good guys to finally be willing to shoot the remaining bad government agents? Not necessarily. For one, consider the flip side of my calculus: it's possible to convince bad people to do good things. Evil people could be convinced to leave the police force by offering better pay as security guards in the agora. As the agora progresses, choosing to work in private security may also increase such people's standing in society. So, it may be more worth their while to do the right thing than to commit evil.

And as for those who remain in the police force regardless? Well, let us ask the question, what is a police officer? A police officer is an agent with the support of the critical mass of the population, otherwise he's a thug or vigilante in a clean shirt. Returning to my above point, the dangers in using defensive force against state agents is that in the eyes of the critical mass of the population, it may as well be revolution. Once the agora has taken hold, and the critical mass of the population has a different opinion, that agent ceases to be a police officer. At this point he works for a rogue agency that has lost most of the respect he had. At this point, there will be little need to make the case for defense against him or her.

Did I just concede Larken's point? No, because Larken's point is that we need to be talking about, and focusing on, this eventuality right now. But we don't. Before it's time, it's dangerous to yourself and to society. When the time comes, it will go without saying. Do we need to speak of violence? Yes, but only to make a reasoned argument against it, to avoid the appearance of being afraid of it, to avoid being tempted into Larken's point of view.

Sunday, August 25, 2013

The Fallacies at the Root of Bitcoin's Value: Part 2 - Troll Economics and Value From Transferability

"Bitcoin has value a tool: you can use it to near instantly make payments across the world, with almost no transaction fees."

In my initial post, I clarify the properties of value, why I believe a source of value outside of trade is necessary to at least rest assured with a given currency, and why I believe that Bitcoin (aka BTC) does not have such a source of value. There are many responses to this point, citing claimed sources of value, but I believe them to be almost always erroneous. Here, I will focus on the above claim of Value From Transferability.

Disagreements about the economic viability of BTC can usually be split into two areas: "Does Bitcoin have consumable value?" and "Does it even matter? (I mean, look at the inflated price of gold!)". With respect to the claim of Value From Transferability, I will only argue against the former. Arguments against the latter can be made independent of this particular claimed source of value, and will be done in future posts.

Some specifics on the nature of value

Most importantly, certain things are valuable because they're directly consumed. The "shininess factor", with regard to things like silver (aka Ag). This is based on personal preference, and its market exchange rate is as reliable as the existence of that preference among independent individuals across the economy. Other things are valuable as tools to help produce or obtain things that have shininess. Still other things have properties, currency features, that help preserve its own value, assuming it has value to begin with. Durability of Ag is a canonical example.

However, all action in the real world is speculative. Even when I value something for shininess, I speculate that I will in fact enjoy it. But this is not speculation on others' behavior, so it is not relevant to this discussion. More importantly, if I'm a holder of Ag for the purposes of exchange, its value from durability depends on another person down the line valuing its shininess, making the value from durability speculative. And if I'm talking about a commodity without any shininess attributes, that is circulating as currency regardless, any properties such as durability has arbitrary speculation, ie I'm effectively guessing people will continue to take it, because they did yesterday.

Problem?

So with that in mind, let's revisit the Value From Transferability claim: BTC has value, because it's useful, because it can extremely cheaply and reliably transfer value across the world. Seems plausible enough. I want to make a transaction of Ag to somebody across the world in exchange for a vintage postage stamp I wish to collect, but there are expensive wire charges involved. However I find that I am able to exchange some Ag for some BTC in order to send that BTC across the world for miniscule fees (and the fees are not zero). Thus, the BTC demonstrably is valuable to me in that moment.

So what is the problem? In short, it is begging the question. If the BTC system were a means of cheaply transferring something with established value, with BTC as the vessel, then yes, that would give BTC a sustainable value. However the BTC system is a means of transferring BTC. Any value inherent in it is established after, and independent of, the transfer. The claim of Value From Transferability shouldn't depend on BTC already having an established value from some other source, otherwise the claim is superfluous. Thus, we are left with BTC having value because it helps me transfer value, that value again being in the form of the ability to transfer value, ad infinitum.

Value From Transferability is a Currency Feature, but without any speculation on somebody appreciating its shininess. Exactly how much value is at the end of this chain of events is completely arbitrary. Thus, in reality, as with essentially every source of value of BTC, it comes down to arbitrary speculation on people's behavior. Again, whether that is an acceptable basis for a currency is the subject of another discussion, but this conclusion should suffice to dispel the claim that Value From Transferability changes this basis.

Preferences in detail

Let's start with the fact that an exchange can take place when two entities have opposite relative valuations of two objects:

V1(A ) < V1(B)

V2(B ) < V2(A)

Where VX is the person X's valuation of the given object.

Base case: Pure arbitrary speculation

Supposing you were to describe a scenario where, as I claim, people choose to use BTC purely based on arbitrary speculation. For example, let's say there is a current exchange rate of 10oz Ag/BTC. However, there is a common fear among certain people that Ag will soon take a dive. But BTC has been holding steady for some time, so it is preferred by those people. Suppose the cost of each BTC transaction is .01 BTC. What would this scenario look like?

The first person prefers to trade in their Ag for BTC at the current exchange rate:

V1(8.1oz Ag) < V1(.81 BTC)

This same person prefers to trade 0.81 BTC for a certain product, P1. To properly demonstrate opposite relative valuations, which is necessary for a trade, we also note that they prefer 0.8 less than either of these:

V1(.8 BTC)

< V1(.81 BTC)

< V1(P1)

The next person prefers to trade P1 for .8 BTC, and trade that for another product, P2. 0.79 BTC is shown, again, to demonstrate opposite relative valuations:

V2(P1)

< V2(.79 BTC)

< V2(.8 BTC)

< V2(P2)

And so on:

V3(P2)

< V3(.79 BTC)

< V3(P3)

Note that the objects are colored to highlight the opposite relative valuations, which allow for the objects to be exchanged, as explained in the beginning of this section.

There's nothing setting the exchange rate of BTC here other than each actor's valuation of their desired product, and their speculation that the next entity will part with it for that much.

Transferring value via BTC

Now let's examine the claim of Value From Transferability, which implies that the above is inaccurate. Suppose I am holding 10oz Ag, which I am willing to exchange for the postage stamp. The stamp vendor is willing to part with it for 8oz Ag so that she can buy a phone. The traditional wire transfer fees are 2oz Ag. The expenses to me would total 10oz Ag, so I am willing to make this transaction.

But then, before I pick up the phone to call Western Union, the stamp vendor hears about BTC from the phone vendor. She explains to me that I can exchange 8.1oz Ag for .81 BTC, send it to her, and I will lose only 0.01 BTC in transaction fees. She can exchange the remaining .8 BTC for the phone, closing the deal. Very directly put, the value of BTC to me here is that it has saved me 2oz Ag. Seems on the surface like the BTC has real use value, but let's examine further.

Since I would be willing to trade 10oz Ag for the stamp, I value 10oz Ag less than I value the stamp. Assuming I could trivially give away silver if I really wanted to, I reasonably value 10oz Ag more than 8.1oz Ag. Here Vm denotes my valuation:

Vm(8.1oz Ag) < Vm(10oz Ag) < Vm(Stamp)

I value .81 BTC more than 8.1oz Ag, because with the Ag I can't directly obtain the stamp. However, I want the BTC for no reason other than to obtain the stamp in an exchange, therefore I value the stamp even more:

Vm(8.1oz Ag) < Vm(.81 BTC) < Vm(Stamp)

Now I am speculating the following, where Vs denotes the stamp vendor's valuation:

Vs(Stamp) < Vs(.8 BTC) < Vs(Phone)

The stamp vendor would, in turn, be speculating that the phone vendor could use the BTC to obtain something he wants:

Vp(Phone) < Vp(.79 BTC) < Vp(Pp)

Now let's restate the above, rearranging some terms, and adding some self-evident terms (valuing more BTC over less):

Vm(8.1oz Ag) < Vm(.81 BTC)

Vm(.8 BTC) < Vm(.81 BTC) < Vm(Stamp)

Vs(Stamp) < Vs(.79 BTC) < Vs(.8 BTC) < Vs(Phone)

Vp(Phone) < Vp(.79 BTC) < Vp(Pp)

This takes the exact form as the arbitrarily speculative base case:

V1(8.1oz Ag) < V1(.81 BTC)

V1(.8 BTC) < V1(.81 BTC) < V1(P1)

V2(P1) < V2(.79 BTC) < V2(.8 BTC) < V2(P2)

V3(P2) < V2(.79 BTC) < V3(P3)

Despite my making a choice of BTC over Ag, the incentives resulting in exchanges are fundamentally the same as the arbitrarily speculative base case. BTC is still valued only by speculating on other people's willingness to take it in exchange for desired products.

But saving 2oz Ag in transaction fees seems to be valuable, how does that not factor in? Well, just as with the base case, the perceived disutility of Ag has no impact on the perceived utility of BTC in obtaining desired products.

A further observation: the fact that using 0.8 BTC can save me 2oz Ag is based on the particular exchange rate. If the exchange rate were 1oz Ag/BTC, it would take 8 BTC for the same effect. In other words, the amount of utility in a given amount of BTC is based entirely on its exchange rates.

Transferring value via a voucher

This may seem altogether counterintuitive. Am I effectively saying that money transfer systems are not fundamentally valuable? No, a transfer system is valuable as a tool, so long as what is being transferred already has value. Let's imagine a product that does transfer value, then.

Supposing that, instead of BTC, I found a wire service where I could spend 9oz Ag for a voucher, which I will denote by v8, which I could transfer half way across the world. 9oz Ag is cheaper than 10oz Ag, so I'll take it.

Vm(9oz Ag) < Vm(10oz Ag) < Vm(Stamp)

Vm(9oz Ag) < Vm(v8) < Vm(Stamp)

Vs(Stamp) < Vs(v8) < Vs(8oz Ag) < Vs(Phone)

Similar rules thus far apply here as with BTC. However, instead of the stamp vendor speculating about a phone vendor, she speculates about the preferences of the wiring company:

Vw(8oz Ag) < Vw(v8, R)

Where R is the reputation retained by the company for honoring its voucher.

Putting this all together, my valuation of v8 is based on the speculation that the stamp vendor will speculate that the wiring company will want to maintain its reputation by honoring the v8. Such a voucher system could not be implemented using BTC because no company has control over the exchange rate. They each must themselves speculate on how other companies would treat BTC. Honoring the v8 on the other hand only takes agreement on the part of one company.

There is no need to speculate on the preferences of further people because the v8 is destroyed at the point of redemption. Unlike with BTC, there's an anchor on the exchange rate, somewhere between 8 and 9oz Ag. I could even trade the v8 in a market, where people would value it based on the utility of transferring 8oz Ag and their trust of the company to redeem it.

Conclusion

Looking at the claim of Value From Transferability, it seems that some BTC proponents see it as a currency feature of BTC, and yet believe that it is inherently useful to the point where it gives it a "shininess factor". I hope that I've shown that shininess does not follow from a currency feature, because shininess happens after the commodity stops being a currency. Alternately, they may see it as a tool to transfer existing value. And indeed, that would make BTC sustainable. I hope that I have shown, however, that only arbitrarily speculative value is transferred. Thus, this feature merely cuts down on losses incurred in transferring BTC, while BTC's value ultimately stems from arbitrary speculation.

Wednesday, June 12, 2013

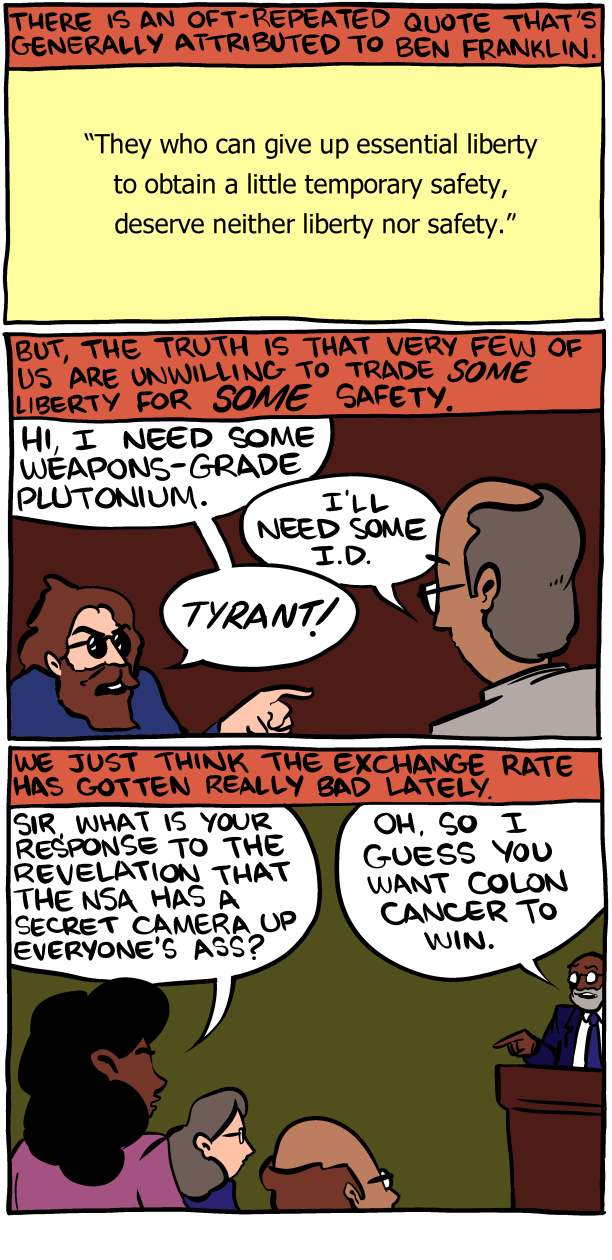

NSA and the unspoken tradeoff

Barack Obama said a lot of silly things in his press conference on Friday in San Jose. However, if you remove the collectivism, he made one very sensible statement: "as a society" (You'll understand the need for quotes in a minute), "we" have to decide on a balance between privacy and security. Agreement with this statement may surprise you coming from a libertarian, but bear with me. It's very popular right now to completely disregard the NSA's claims that they are protecting us from a terrorist threat, and indeed there's plenty of reason to be skeptical of any secretive organization. However, I think that in a world with everybody acting of their own accord, where it's not all that hard to kill a lot of people at once, it seems at least rather plausible, to me, that the right group of people finding patterns in human activities can help anticipate such events. I won't go into the details of this, other people have written about it and you should probably consider what they have to say. However I will just take as a given, for the purposes of my argument, the plausibility that some amount of security can be bought at the cost of privacy.

So why am I so easily conceding this point as a libertarian? Have I gone soft? Isn't it the libertarian position that no amount of privacy is an acceptable compromise for security? No, the libertarian position is on a third axis, advocating for the maximization of liberty, which should not get conflated with privacy. Liberty is the ability to actually have a choice in the matter, between security and privacy, and as Mr. Obama implied, each of us can have a preference on how to best optimize between privacy and security in our own lives.

The distinction is much easier to illustrate this using everybody's other favorite *SA organization.

Hands in the air, citizen

Again, as much as I like to talk about overblown threats, I will concede that there is a non-zero utility to extra scrutiny at the airport (even if the TSA doesn't happen to be providing any such utility with their current procedures). However, a lot of people do believe that the TSA's procedures involving body scans are a violation of privacy.

Assuming you, the reader, are among them, I will ask you, why exactly is this a violation? Is it a matter of the degree of privacy invasion? Would it suddenly become morally acceptable again if the TSA only tried to detect metal on your person? Is this not also a violation of your privacy? How is that fundamentally different?

The principle in play cannot be that violations of privacy are categorically wrong, or else a metal detector would be considered a lesser violation, but a violation all the same. The principle cannot be that some sorts of privacy violation are acceptable, if it is below a certain threshold; that could only be a preference, not a principle. If that were the case, body scanners would not be an outrage as much as a matter of dissatisfaction with the conditions.

No, a metal detector is not fundamentally different. The reason there was no noticable outrage with metal detectors is that most people do not feel personally invaded when a metal detector is used on their person. Thus, the decision the government made for them happens to be the same one they would make for themselves. Two morally equivalent situations are producing a moral reaction only if the degree of one of the variables is sufficiently high, and I think the explanation is a moral principle at play that many people fail to recognize. What's going on is that there is an implicit moral problem that the government has made that decision for you. There is no transaction here between you and the government that has merely left you dissatisfied, the government just stepped in the way. The only transaction is between you and the airline, and the government has restricted the conditions you are allowed to make with the airlines.

credit: Saturday Morning Breakfast Cerial comics

One way to resolve this situation is to abolish the TSA, and hold the airlines liable for any damages done by, and (by default, before any waivers) within, their aircraft. They will have to decide how much they would be risking at each level of customer privacy intrusion, and how much privacy customers are willing to part with at the corresponding price point and with the corresponding gain in their own security. Once this occurs, there can be some justice in the matter, because the customer will be making a voluntary agreement (or not) with the airline, with no third party forcefully interjecting themselves.

We as a society

So let's go back to where Barack Obama talks about how "we as a society need to decide". This is obviously asinine on its face, as many have already pointed out, because "the society" wasn't even consulted on the matter, as they have been unaware of these NSA programs until last week. This makes it particularly outrageous, but is this the only source of outrage? Even if we knew about the program all along, do you suppose there would be no moral outrage? He still made the decision for you, and I'd be willing to bet that for a vocal handful of you, this would go beyond your threshold of preference. This is no different than the decision made by the TSA, that decision was made wide in the open. "The people" were well aware of it. Yet there was still a moral outrage.

And this comes to why I use quotations for these collectivist statements.

Perhaps there's a world where the snooping program is very popular, and you are one of a small minority who are not keen on it. Does it make it any less outrageous that somebody is making the decision for you, even if it's endorsed by 90% of the people around you?

The fundamental problem here is that there is no such thing as a decision made by a society. Decisions require thoughts, preferences, and reason, and the only relevant entities with these faculties are individual persons. A society as a whole has no such faculties. There is such a concept as "the will of the people", but to have any meaning it can only be a function of the wills of each individual person, and usually an ill-defined function at that. Majority rule is the usual standard, but there is nothing special about this particular function that makes it any more a true will of "the people", because "the people" is not an entity. Abiding by the output of such a function merely attempts to minimize the dissatisfaction of the members of the society. It aims to optimize for preference, but it can not make the outcome any less immoral.

This is why the government constantly claims to speak for "the people", to the outrage of so many persons. This will keep happening so long as enough individuals believe in this sort of collectivist concept. Outrage is not merely the result of corrupt persons within the government, though that is of concern, and those persons are happy to take advantage of this common collectivist viewpoint. This viewpoint is altogether illogical and will always lead to unhappy results.

A moral compromise

This episode is particularly outrageous because the founding documents that are used to justify Mr. Obama's power are written based on the principle that Americans have rights a priori. The government is instituted among "the people" (ok, so they weren't perfect), and is given permission, by "the people" to occasionally violate the rights of persons. The government does not dispense rights onto individuals at the government's discretion. Mr. Obama is in no position to be lecturing the individuals living within the US borders on what sort of intrusion they should be ok with, and what sort of "accountability" we should all be ok with. He should be asking for your forgiveness for taking your liberty! Do not let Mr. Obama tell you that there is a choice "the people" have to make, between privacy and security. Make your own judgement: is it an acceptable compromise of liberty that the president is even in the position to make this decision on your behalf? Because for him to even be in that position requires a moral compromise, with your liberty on the receiving end.

Unlike with the TSA, it is hard to conceive of a voluntary arrangement performing the same tasks as the NSA (though I am not asserting that it cannot be done). As such, you may be willing to make a compromise along the axis of liberty, since under the NSA everybody within the US borders has to have the same policy imposed on them. Because you value security, and because the threat is perhaps so great, you are willing to sacrifice a certain amount of liberty, which leads to a sacrifice of a certain amount of privacy at the discretion of the politicians. So when you consider this, recognize that if you accept the existence of the NSA, you are inevitably making a moral compromise, not just a compromise in privacy. Yea, if you accept the existence of any government program, you are making a moral compromise.

Now, am I saying you should never make a moral compromise? I will not necessarily tell you that, at least not for the purposes of this argument. To take an extreme example, I would personally be willing to put up with a certain amount of moral compromise if I truly believed it was the only way to prevent a nuclear holocaust. But I ask you, when considering a proposal for an expansion of government, don't just weigh "pros" and "cons", and let the government tell you that they're balancing your privacy, security, or any other factors for you. Recognize that any proposal for an expansion of government is immoral first and foremost, and then decide if the moral compromise is worth it, and consider if there is an alternate solution, not involving government expansion, that allow for individuals to balance these factors according to their own preferences.

Thursday, June 6, 2013

The Fallacies at the Root of Bitcoin's Value: Part 1 - "Intrinsic Value"

From the beginning when I heard about BTC, I thought, here's something that excites a few technologically oriented libertarians because of its subversive nature. But these must be libertarians who haven't thought that much about the economics involved. Any day now, I assumed, the opponents of fiat currency would get word of it and step in and set their brethren straight. This was, after all, a currency which, just like the Federal Reserve Note (aka FRN, aka US Dollar) is backed by nothing of what I considered actual value. This is "fiat currency", without the fiat. The only fundamental difference, I figured, is that it cannot be inflated (which I will not deny is in itself very important). Of course instead, it's taken the libertarian world (among other worlds) by storm. It started with a lot of skepticism, but most of the skeptics seem to have been won over. There remains a handful of holdouts, and today, at least vocally, we seem to be in the minority.

So I will try to make my economic case against BTC in a series of posts (it's unfortunately ballooned into something way too big for a single post). I will not go into certain economic criticism, such as the argument that it is bad for being deflationary. Other people cover that argument better than I do, and I'm not sure how I feel about it anyway. I will go into very few technical details, there are again much better sources on the Internet than myself for that.

Fiat Currency, without the Fiat

My principal argument against BTC is that it has no significant use value, and as such its value almost entirely consists of a bubble, and is bound to collapse. I say "significant" use value because I will concede that the current novelty of BTC very likely has an effect, however I suspect novelty cannot last after it is no longer novel. Beyond that, it is merely people speculating on that novelty, and (likely to a greater extent) on each other's speculation.

Of course this is nothing new, it's an argument that BTC proponents have heard all too often and for which they have prepared counterarguments. However I believe that the counterarguments are not well founded. Just about every claimed source of value of BTC fails, in my mind, to justify it. Some claimed sources, such as scarcity, are not actually a source of value (though it affects price). Some, such as value from being able (with some effort) to buy anonymously, are actually a secondary source of value which requires an existing primary source (no different than how durability of metal adds value to it). Some, such as value from being accepted by vendors, are merely a form of speculation.

If you agree with me so far, there's also the counterargument that precious metals have the same concern as BTC, that they must be in a massive bubble right now given how high they're trading over what one may presume would be their market rate purely from use value. This may be true, but I'm inclined to think that their use value gives the exchange rate a certain floor. If the Silver (aka Ag) price were to crash to near zero, some enterprising individuals would make bids for as much Ag as they could get their hands on in order to sell it to consumers, and this would very quickly revive the exchange rate. A new bubble could always reform on top of this. BTC has no such guarantee.

If this is still not a cause for concern to you as a BTC proponent, I understand. Personally, it makes me inclined to think that BTC cannot last in the long run, but I'm not able to make any stronger argument that it wouldn't. However, I would at least like you to recognize along with me how little BTC is hanging on.

I have barely touched the specific counterarguments here, I will go into all of these counterarguments in detail in future posts. However for this post, I would like to first address the important question of reasoning about value in itself.

"Intrinsic Value"

What is meant by value, exactly? Some fellow opponents of BTC will point out that BTC has no "intrinsic value". Proponents will be quick to point out that there is no such thing as "intrinsic value". Note that I did not use this term in stating my own case, because I realized that this term is too ambiguous to be worth using in this discussion. Of course the proponents are correct that all valuation is totally subjective. Nothing has "intrinsic value", in that the value of an object is the value an individual attributes to that object. From this standpoint, yes, it looks very much like Ag and BTC are on equal ground. However there is more to be said about the nature of value.

We must have a starting point when discussing value. It is difficult to give a sufficient definition of value, but fortunately we can sidestep this specific question. It suffices to attribute to value the following property: value manifests as an individual's decision to choose one action or object or set of objects over another. In economics, there is no need to describe exactly what, if anything, value actually means. There is no need to attribute a cardinal or nominal quantity to value. When it comes to one collection of commodities over another, we only need to declare that something is of greater value than another to a given individual if that individual chooses that thing over the other. As such, despite valuation being subjective by definition, its manifestation is objective. Also worth noting is that we can attribute ordinal quantity to value.

Ultimately, all decisions in an economic actor's life aim toward a state of maximum satisfaction. This satisfaction is very generally defined, and can take on many forms. But all actions have an ultimate purpose, with a logical framework (however faulty), and a set of information (however faulty) that has lead the person to believe that their satisfaction will most likely be maximized given a particular action. Thus, if a person values one collection of commodities over another, it is tantamount to saying that the person believes, given certain information and logical reasoning, that the chosen collection will lead to greater satisfaction than the other collection.

There may be fundamentally different sources of value. Some sources of value stem from an expectation of immediate gratification. Some sources of value stem from the conclusion that the object may later be exchanged for something that will give greater gratification. This is where the differences between BTC and Ag start to arise. Given what I've asserted about value, BTC demonstrably has value, because people are choosing to exchange other things for it. However I argue that certain fundamentally different sources of value apply to Ag that do not apply to BTC, and they have consequences that affect how people will value these commodities in the long term.

I will briefly note here that we can observe the consequence of valuation between different commodities by their exchange rates. Though valuation and exchange rate have an effect on one another, they are not synonymous. I will talk more about this in a later post when I discuss scarcity. Furthermore, there are factors in addition to valuation that affect exchange rate, and (more obviously) there are factors in addition to exchange rate that affect valuation. However, if the valuation of a certain commodity by everybody in the market is none, it would imply that nobody would exchange anything for that commodity, thus the commodity would have a zero exchange rate vis a vis every other commodity.

Different sources of value

The reason it's important to understand the nature of value is to highlight the fact that there are sources of value that are fundamentally different from each other in nature. Again, some sources of value of an object are due to the user deriving satisfaction directly from the object. In such cases, the valuation is unaffected by valuations that other people make on the object. Supposing an economic actor, Sally, reasons that if she makes the decision to make an exchange of coffee for Ag, she will be happier for it. Sally is making a subjective valuation, based on her own direct preferences between coffee and Ag.

Some other sources of value are based on the actor's understanding of the state of the economy. For instance, supposing an economic actor, Jim, would be directly satisfied by coffee, but he currently holds grapes. His reasoning may be that if he makes the decision to make an exchange of a certain amount of grapes for a certain amount of Ag, he can make another exchange with the Ag at a later point in time for a certain amount of coffee. Jim is also making a subjective valuation, but it is not simply based on his own preference between grapes and coffee, but also based on his speculation on the existence of somebody like Sally, who values Ag and holds coffee.

If there is a general tendency for Ag to render utility for individuals such as Sally, there should always be the potential for an exchange rate between Ag and other commodities. If there is a general tendency for individuals such as Jim, people who believe in the existence in Sallys, to exist, there will be a potential for an exchange rate, so long as Jim still believes in the existence of Sally. If Jim one day realizes he is wrong, his valuation will have to make a correction, and if this happens after he trades his grapes for Ag, he will be left disappointed.

So, when fellow opponents of BTC talk about BTC's lack of "intrinsic value", they are generally talking about the lack of valuations similar to Sally's. Yes, both Sally's and Jim's valuations are subjective, like all valuations, but only Sally fully understands her own preferences. Holders of a commodity are generally like Jim. They are hoping that Sally exists. It doesn't suffice that other Jims exist, because making a valuation based on that sort of speculation would just be betting that other bets. They don't just want to know that there are other people placing the same bet, they should be looking for assurance that they're right.

Final Comments

This is armchair economics. However, lest I try to take credit for others' ideas, I will note that a lot of my examination is informed by my casual readings into the Austrian school of economics, in that I'm analyzing the logical outcome of scenarios based on individual purposeful actions, with expected outcomes based on logical reasoning (faulty or otherwise). However one thing that still doesn't make any sense to me is Mises' regression theorem (though I haven't read deeply into it yet). What I am arguing probably flies in the face of it (even though I know some Austrian holdouts actually use this same theorem to argue against BTC). And I know that some, if not most, Austrian economists are in favor of BTC. So, all the same, don't take anything I'm saying as a fair representation of the Austrian view. (And if Robert Murphy reads this and sets me straight it would make my day.)

As I have considered the potential sources of value of BTC, I have come up with more specific classification than what I've described here. In my next post, I will talk more about them, and how they apply to commonly claimed sources of value put forth by BTC proponents. In subsequent posts, I will address specific claimed sources of value in greater detail.